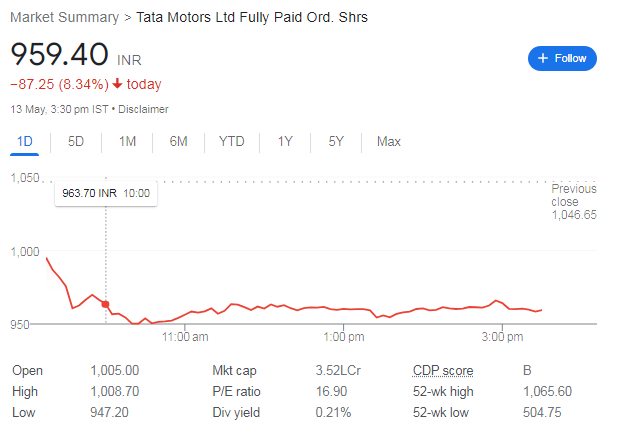

Overview of Tata Motors Share Plunge:

Tata Motors shares took a significant hit, plummeting by 8% to 9% after facing multiple downgrades and receiving cautious commentary. This sharp decline in share price has raised concerns among investors and analysts alike.

Concerns over Moderate Growth Outlook:

Brokerages have expressed concerns regarding Tata Motors’ moderate growth outlook for FY25. The cautious commentary surrounding the company’s future prospects has contributed to the downward pressure on its share price.

Impact of Q4 Results on Share Price:

The drop in Tata Motors’ share price comes on the heels of the release of its Q4 results for 2024. The market reaction reflects investors’ response to the company’s financial performance and outlook provided in the quarterly report.

Evaluation of Buying Opportunity:

With Tata Motors shares experiencing a significant decline, investors are deliberating whether the dip presents a buying opportunity. The decision to buy, sell, or hold Tata Motors shares hinges on individual risk tolerance and market sentiment.

Revised Target Prices and Market Volatility:

Analysts are reassessing their target prices on Tata Group stock in response to the market volatility and the recent developments affecting Tata Motors’ share price. These revisions underscore the dynamic nature of the stock market and the need for careful analysis.